- From Don Stacey

- Indexcalls.com

-

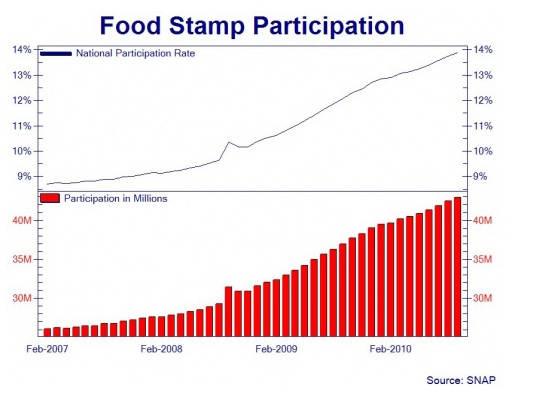

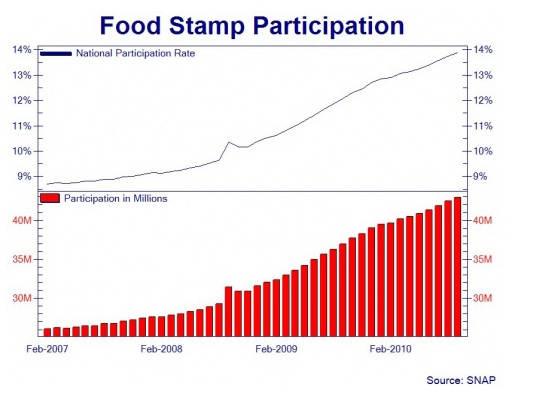

- Because a picture paints a thousand words, here is "our"

V-as-in-vibrant V-shaped recovery, expressed perfectly in a single picture.

-

-

-

-

-

- ===========================

-

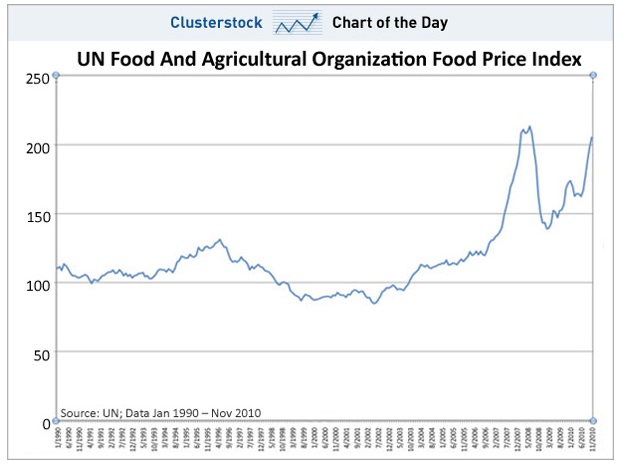

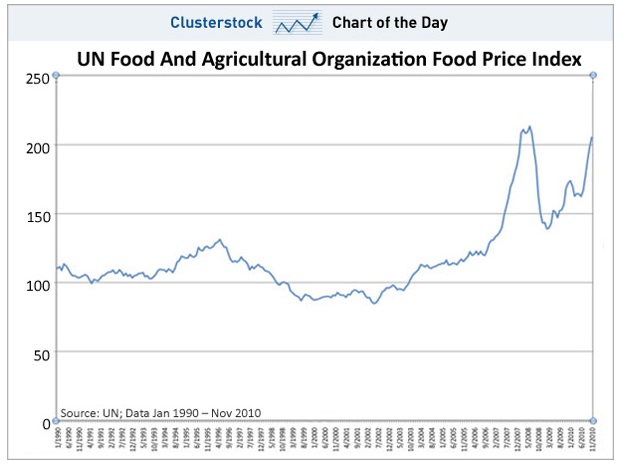

- CHART OF THE DAY: Global Food Prices About To Break An

All Time High

- Gregory White | Dec. 1, 2010

-

- Inflation in emerging markets is hitting food prices

hard, and now we have raw data from the UN to confirm.

-

- The latest report from the UN Food and Agricultural Organization

shows prices are back at 2008 levels, and have increased for five months

in a row.

-

- The data evaluates 55 different food commodities, so

it's a pretty broad gauge of world costs.

- Whether or not costs are high enough yet to lead to a

world food crisis remains to be seen, but further inflationary pressures

on emerging markets, where there are the most mouths to feed, will remain

a threat.

-

-

-

-

- +++++++++++++++++++++++++++++++++++++++++++++++

-

-

Is Capitalism Dead? Is Capitalism Dead?

-

- Wednesday, December 08, 2010 by Staff Report

-

- As the recession grinds on, politicians in most industrial

countries have an incentive to make exaggerated claims about the supposed

coming economic recovery. Some say the recession is over. Obama is in the

group that claims we're on "the road to recovery," while other

nations can only spot recovery "on the horizon." Below are seven

important social phenomena that point to a more realistic economic and

political outlook. Tehran Times

-

- Dominant Social Theme: In this case, none. Tehran Times,

an "international" newspaper tells the truth more succinctly

than major Western media.

-

- Free-Market Analysis: Is there a recovery? Do you feel

it, dear reader? Deep down in 'dem bones? We don't. We've explained the

reasons why in dozens of articles: The fiat meltdown of 2008 was a meltdown

of MONEY caused by the Internet's ability to expose the truth of a fraudulent

central banking controlled monetary system and the power elite who benefit

from the process of wealth redistribution. It was not caused by "faulty"

economies specifically. It is the system itself that collapsed and at the

base of it all is the myth of the mighty US dollar. When Goldman Sachs,

(as just revealed recently in Federal Reserve info about where US$3 trillion

went in 2008 disbursements) needs billions on a regular basis to sustain

itself, you've got a SYSTEMIC problem, not one having to do with sour investments.

-

- What "melted down" in 2008, as we've long observed,

was a 100-year-old central banking system. The mainstream Anglo-American

media won't comment on this of course. We're still... http://www.thedailybell.com/1583/Is-Capitalism-Is-Dead.html

-

-

- ++++++++++++++++++++++++++++++++++++++++++++

-

-

- U.S. tax deal squeezes potential home buyers

-

- REUTERS - 10:03 PM ET 12/08/10

- By Al Yoon and Daniel Trotta

- NEW YORK (Reuters) - For Kathryn Confer, refinancing

the mortgage on her home in Erie, Pennsylvania, became a race against time

-- first because she was drowning under a 10.5 percent interest rate and

then because of the U.S. Congress.

-

- Confer wanted to avoid the unintended consequences of

the political compromise struck by President Barack Obama and congressional

Republicans to extend lower tax rates to all Americans, including high

earners.

-

- Yields in the U.S. Treasury bond market spiked on Wednesday

as investors worried the deal would inflate further the ballooning U.S.

deficit, pushing mortgage rates upward just as the U.S. housing market

was showing some signs of recovery.

-

- Confer, 57 and coming off a divorce, closed on her refinanced

mortgage last week at 4.5 percent, which she said was just in time.

-

- "I was panicking. I was scared to death. ... I knew

they (rates) were going up. They had to be going up because of everything

that was going on in Congress," Confer said.

-

- The U.S. housing market -- reeling from the economy's

worst downturn since the 1930s -- is struggling to... https://news.fidelity.com/news/news.jhtml?cat=Top.Investing.RT&articleid

- =201012081917RTRSNEWSCOMBINED_TRE6B76HL_1&IMG=N

-

-

- Begin forwarded message:

-

- From: EEXI

- Subject: ZH: Elites releasing weapons of mass distraction,

TYP

-

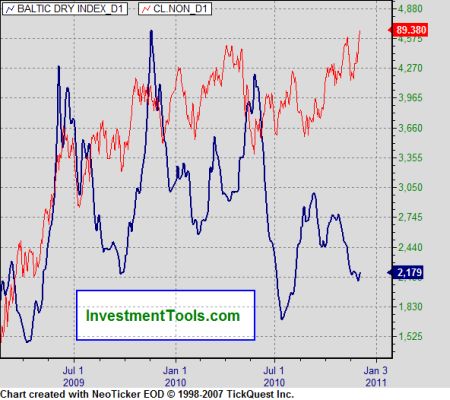

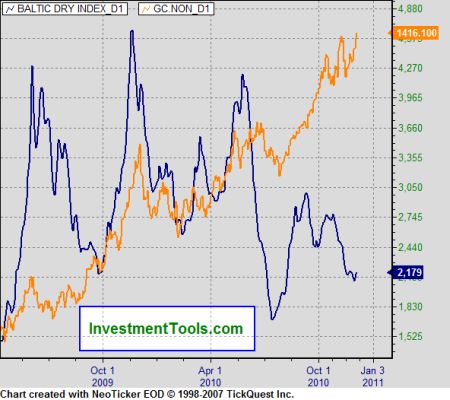

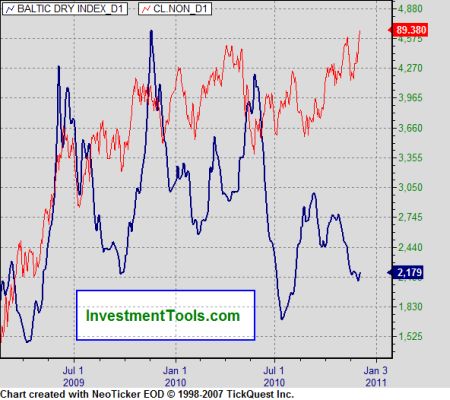

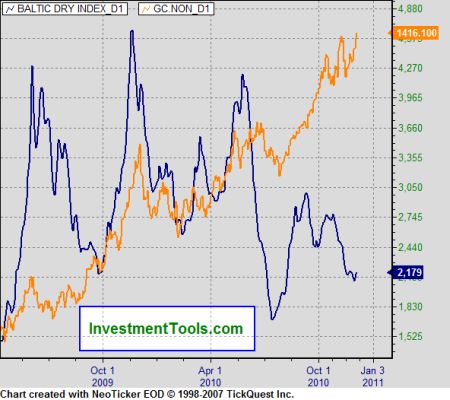

- Bruno's latest includes several excellent charts

displaying inverse proportional relationships between stocks and commodities

versus the BDI. This oddity, as he argues below, signals beginning HYPERINFLATION,

mostly in the US.

-

- 07 December 2010

-

- Baltic Dry Index (BDI) -6 2173

-

- Bruno writes:

- ... while there is growing need for materials in places

like China, this is certainly not at all the driving force behind the explosion

in prices. A good way to gauge this is by examining the BDI (Baltic Dry

Index).

- The BDI measures the cost of shipping raw materials across

the ocean as well as the amount of goods being shipped. It is one of the

few economic indicators that cannot be manipulated by international banks

or governments. A dramatic drop in the BDI shows a sharp decrease in demand

for global shipping and thus reveals a slowdown in the overall economy.

This is exactly what occurred at the beginning of the credit crisis in

2007-2008. However, the BDI can also be measured in comparison with the

values of stocks and commodities. Under normal conditions of supply and

demand, if the BDI were to drop (or deflate), then the value of most stocks

and goods should also drop. This has not been the case, as the below graphs

illustrate:

-

-

-

-

-

-

-

-

-

-

- Now, there have been small deviations in the past between

stocks and commodities versus the BDI, but usually it is the BDI which

leads the deviation, and not the commodities. As the final year of every

graph shows, there has been a significant decoupling of the price of stocks

and goods when compared with the amount of shipping of those goods. To

put it simply; demand is low, all over the world, yet prices continue to

climb skyward at an incredible pace.

-

- Much of the fiat the Fed throws out is going into foreign

entities, we have not seen effects as pronounced as they would be if all

that cash was flowing into our local markets.

-

- ========================

-

- Response to my letter exposing their game and calling

for social credit to put high-finance crime syndicate out of business and

us justice, happpiness and prosperity: one letter.

-

- The reply is from Larry Cohen:

-

-

- Date: Thu, 9 Dec 2010

- Subject: Re: Boiling it down: Moneyed aristocracy are

selling their securites and their gold for cash so they can buy millions

of forclosed US real estate properties for rentals.

- From: larrycohen8@gmail.com

- To: oldickeastman@q.com

-

- http://beforeitsnews.com/story/301/439/Why_Use_Gold_As_Money.html

-

- Eastman,

-

- As soon as you have your social credit money set up,

let me know.

- First, check to see if I'm still alive. If you die

first, plan to have someone else contact me, and I may pay them with an

ounce of silver, if it isn't up to a million dollars by that time. I do

appreciate your efforts to straighten out the money system, but right now,

silver is more do-able, for the reasons I already mentioned to you while

you were still giving me the time of day.

-

- It's alright . . . usually when people ignore me, it

means they know I'm right, and they have nothing else to say. Being right

is a lonely occupation. Larry

-

- On Thu, Dec 9, 2010 at 2:12 AM, RICHARD EASTMAN <oldickeastman@q.com>

wrote:

- Boiling it down" The Moneyed aristocracy are selling

their securites and their gold for cash so they can buy millions of foreclosed

US real estate properties for rentals -- so they can become the landed

aristocracy of a restored feudalism.

-

- You really don't want them to do that.

-

- They build up our debt levels, which must always result

in deflation since more always is paid back than is borrowed, and withdrew

the money from the domestic economy, holding it outside the US. The domestic

deflation caused a depression which resulted in foreclosures. Gasoline

and agribusiness prices were raised by monopoly power to worsen the burden

on borrowers, forcing them into the red. Then when our houses were taken

from us gone, a congress and president owned by the Money Power, arranged

for the Moneyed Aristocracy to be given more than $3 trillion dollars,

in addition to their hoarding of interest earnings and their sales of gold

to the very misinformed -- giving them the economic power to conquer the

United States by buying it.

-

- That is my contention. Do you believe me or not? Are

you willing to declare yourself in this conflict or not? You let them

get away with the 9-11 false-flag mass-murder to put us at war. Do not

stand idly by while they sell your family and friends into slavery.

-

- Dick Eastman

- Yakima Washington

-

- I'm for social credit and Jeffersonian freedom. What

are you for?

-

- http://www.citizensamericaparty.org/socialcredit.htm

-

-

- As you know Dick, I disagree with you on some things

but you have a really good analysis here: I am telling everyone about the

two loop theory: it's definitely got resonance and it's easy to explain

-

- Ian H

|

Is Capitalism Dead?

Is Capitalism Dead?