-

- The Government bailout of the debts of Fannie

Mae is but the next stage of the Tsunami catastrophe ravaging the US economy

-

-

-

-

-

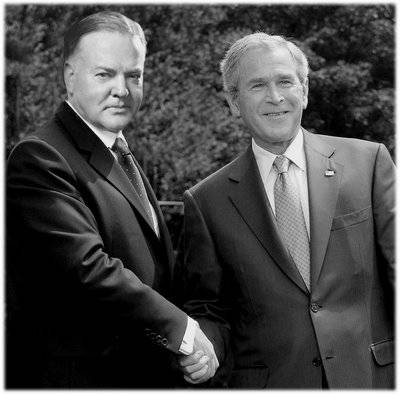

- George W. Bush is already predestined to go down

in history books as the Second Herbert Hoover as the Second Great Depression

deepens

-

-

-

-

- Treasury chief Paulson and Fed chief Bernanke

are part of the 'Plunge Protection Team' to rescue Wall Street at taxpayer

cost

-

-

- The announcement by US Treasury Secretary Henry Paulson

together with Federal Reserve chief Bernanke, that the US Government will

bailout the two largest guarantors of housing mortgage debt-the Fannie

Mae and Freddie Mac-far from calming financial markets, has confirmed

what we have said repeatedly in this space: The Financial Tsunami which

began in August 2007 in the relatively small "sub-prime" high

risk US mortgage securitization market, far from being over, is only gathering

momentum. As with the Tsunami which devastated Asia in wave after terrifying

wave in December 2004, the financial Tsunami we are witnessing is a low-amplitude,

long-wave phenomenon of trillions of dollars of financial securities being

unwound, defaulted on, dumped on the market. But the scale of the latest

wave to hit, the collapse of confidence in the two Government-Sponsored

Entities, Freddie Mac and Fannie Mae, is a harbinger of worse to come

in what will be the most devastating financial and economic catastrophe

in United States history. The impact will be felt globally.

-

- The Royal Bank of Scotland, one of the largest financial

institutions in the EU has warned its clients "A very nasty period

is soon to be upon us-be prepared." They expect the S&P-500 index

of US stocks, one of the broadest stock indices in Wall Street used by

hedge funds, banks, pension funds could lose almost 23% by September as

in their term, "all the chickens come home to roost" from the

excesses of the US-led securitization revolution that took hold after

the dot.com bubble burst and Greenspan lowered US interest rates to levels

not sustained since the 1930's Great Depression.

-

- This all will be seen in history as the disastrous Alan

Greenspan "Revolution in Finance,"-the experiment in Asset

Backed Securitization, a mad attempt to bundle risk in loans, "securitize"

them in new bonds, insure them via specialized insurers called "monoline"

insurers (they only insured financial risks in bonds), rate them thereby

via Moody's and S&P as AAA, highest grade. All that was done so that

pension funds and banks around the world would assume they were high quality

debt paying even higher interest than safe US Government bonds.

-

- Fed in Panic Mode

-

- While he is getting praise in the financial media for

his "innovative" and quick reactions to the un-raveling crisis,

Fed chairman Ben Bernanke in reality is in a panic mode with little short

of hyperinflationary tools at hand to deal with the crisis. Yet, his

room to act is increasingly bound by the soaring asset price inflation

in food and oil which is pushing consumer price inflation to new highs

even by the doctored "core inflation" model of the Fed.

-

- If Bernanke continues to act to provide unlimited liquidity

to prevent a banking system collapse, he risks destroying the US corporate

and Treasury bond market and with it the dollar. If Bernanke acts to save

the heart of the US capital market-its bond market-by raising interest

rates, its only anti-inflation weapon, it will only trigger the next even

more devastating round in Tsunami shock waves.

-

- The real significance of the Fannie Mae bailout

-

- The US government passed the law creating Fannie Mae

in 1938 during the Great Depression as part of President Franklin D. Roosevelt's

New Deal. It was intended to be a private entity but "government

sponsored" that would enable Americans to finance buying of homes,

as part of an economic recovery attempt. Freddie Mac was formed by Congress

in 1970, to help revive the home loan market. Congress started the companies

to promote home buying and their charters give the Treasury the authority

to extend a $2.25 billion credit line.

-

- The problems in the privately-owned Government "Sponsored"

Entities or GSEs as they are technically known, is that Congress tried

to fudge on whether they were subject to US Government guarantee in event

of a financial crisis as the present. Before now, it always appeared a

manageable problem.

-

- No more.

-

- The United States economy is in the early phase of its

worst housing price collapse since the 1930's. No end is in sight. Fannie

Mae and Freddie Mac, as private stock companies, have gone to excesses

in leveraging their risk, most as many private banks did. The financial

market bought the bonds of Fannie Mae and Freddie Mac because they bet

that the two were "Too Big To Fail," i.e. that in a crisis the

Government, that is the US taxpayer, would be forced to step in and bail

them out.

-

- The two, Fannie Mae and Freddie Mac, either own or guarantee

about half of the $12 trillion in outstanding US home mortgage loans,

or about $6 trillion. To put that number into perspective, the entire

27 member states of the European Union in 2006 had an annual GDP of slightly

more than $12 trillion, so $6 trillion would be half the GDP of the combined

European Union economies, and almost three times the GDP of the Federal

Republic of Germany.

-

- In addition to their home mortgage loans, Fannie Mae

has another $831 in outstanding corporate bonds and Freddie Mac has $644

billion in corporate bonds.

- Freddie Mac owes $5.2 billion more than its assets today

are worth meaning under current US "fair value" accounting rules,

it is insolvent. Fair value of Fannie Mae assets has dropped 66% to $12

billion and may as well go negative next quarter. As the home prices

continue to fall across America, and corporate bankruptcies spread, the

size of the negative values of the two will explode.

-

- On July 14, symbolically the anniversary of Bastille

Day, US Treasury Secretary Paulson, former chairman of the powerful Wall

Street investment bank Goldman Sachs, stood on the steps of the US Treasury

building in Washington, a clear attempt to add psychological gravitas,

and announced that the Bush Administration would submit a bill proposal

to Congress to make taxpayer guarantee of Freddie Mac and Fannie Mae explicit.

In effect, in the present crisis it will mean nationalization of the $6

trillion agencies.

- The bailout by Paulson was accompanied by a statement

by Bernanke that the Fed stood ready to pump unlimited liquidity into

the two companies.

-

- The Federal Reserve is rapidly becoming the world's largest

financial garbage dump as for months it has agreed to accept banks' Asset

Backed Securities including sub-prime real estate bonds as collateral

in return for US Treasury bond purchases. Now it agrees to add potentially

$6 trillion in GSE real estate debt to that.

-

- However, the disaster in the two private companies was

obvious as far back as 2003 when grave accounting abuses in the two companies

were made public. In 2003 then President of the St. Louis Federal Reserve,

William Poole publicly called for the US Government to cut its implied

guarantee of Freddie Mac and Fannie Mae claiming then that the two lacked

capital to weather severe financial crisis. Poole, whose warnings were

dismissed by then Fed Chairman Greenspan, called repeatedly in 2006 and

again in 2007 for Congress to repeal their charters and avoid the predictable

taxpayer cost of a huge bailout

-

- As financial investors warn the Paulson bailout is not

a bailout of the US economy but a direct bailout of his Wall Street financial

cronies. What until recently had been the largest bank in terms of loans

outstanding, Citigroup in New York, has been forced to raise billions

in capital from Sovereign Wealth Funds in Saudi Arabia and elsewhere to

remain in business. In its May announcement, Citigroup's new Chairman

Vikram Pandit announced plans to reduce the bank's $2.2 billion balance

sheet of liabilities. However, he never mentioned an added $1.1 trillion

in Citigroup "off balance sheet" liabilities which include some

of the highest risk deals in the US real estate and securitization era

it so strongly backed. The Financial Accounting Standards Board in Connecticut,

the official body defining bank accounting rules is demanding tighter

disclosure standards. Analysts fear Citigroup could face devastating new

losses as a result with value of liabilities exceeding the bank's $90

billion market value. In December 2006 prior to the onset of the Tsunami

crisis, Citigroup had a market value of more than $270 billion.

|