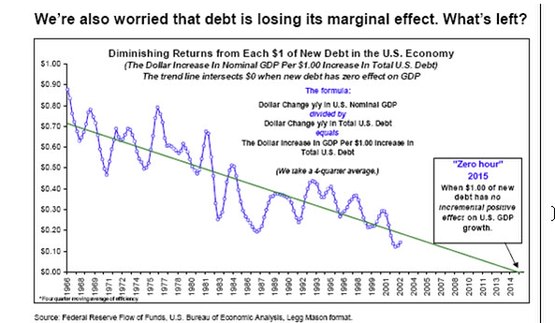

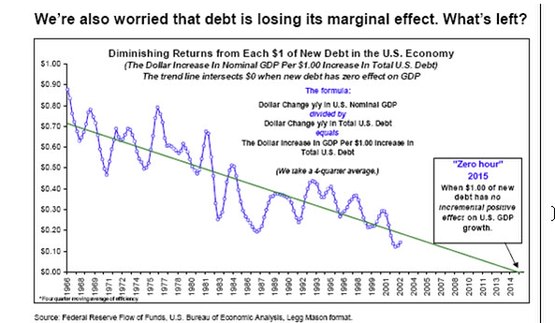

- The chart below, provided to me by Barry Bannister, clearly

illustrates the countdown to hyperinflation.

-

-

- Chart: Courtesy Barry Bannister

-

- The financial system will collapse before "zero-hour"

actually occurs. I think we are seeing signs of it in the desperate measures

being employed to nationalize companies which trade on market exchanges

as private enterprises. There is simply no way to defend the SEC's decision

to selectively enforce the prohibition of naked short selling for 17 'fragile'

financial companies and to not enforce it for the over 5000 other companies

which trade on US stock market exchanges. And plans to rescue Fannie Mae

and Freddie Mac breathe of a sort of corporate nationalism. Over time this

will deal a massive psychological blow to financial markets. They are currently

rallying on the sense of relief that the efforts to prevent Fannie and

Freddie from dragging US financial markets into the abyss have succeeded

and the inevitable day of reckoning has been postponed once again.

-

- But this time around market participants are beginning

to smell blood and are beginning to consider that US dollar's status as

the world's reserve currency is in jeopardy. It is now clear that the Bear

Stearns bailout was not the bottom and that the bottom has not likely occurred.

Many were betting that the market lows in March would hold and that the

demise of Bear Stearns marked the nadir from which markets were sufficiently

cleansed to begin their new ascent higher.

-

- In the past such events did in fact mark the bottom.

Going back to the 1987 market crash we have had a series of market crises,

each one met by massive Federal Reserve liquidity injections, which ignited

a new phase to the bull market rally. We saw similar effects after the

Long Term Capital Management (LTCM) debacle in 1998 and the series of rate

cuts that followed the collapse of the internet bubble and the 9/11 bombings.

-

- Yes, not only are we are witnessing the asymptotic approach

of the marginal effect of debt, but we are now seeing the dwindling market

impact US Government market interventions are having. In a commentary just

written by Ron Paul, titled "The Crisis is Upon Us," he writes,

"There are reasons to believe this coming crisis is different and

bigger than any the world has ever experienced." He is largely dismissed

as a quack by the mainstream for being "Chicken-Little" and for

not being as polished as our current crop of focus-group-driven politicians.

He subscribes to an economic philosophy not taught in our American schools

called Austrian economics. But after the final crisis plays itself out,

the mantra "We are all Keynesians now," will be replaced by "We

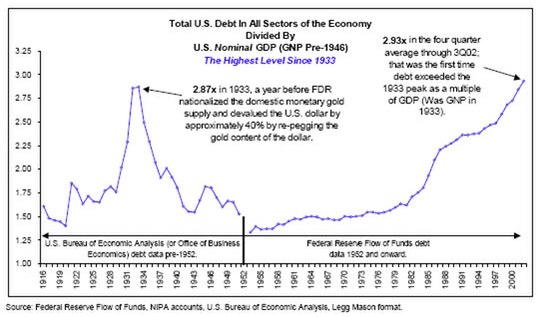

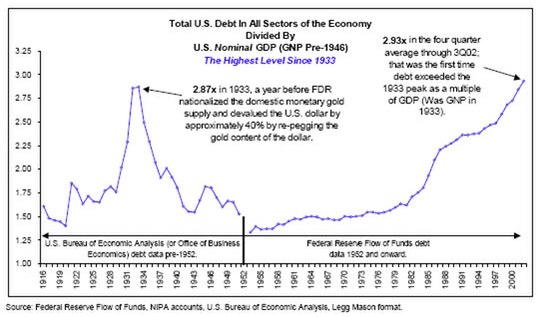

are all Austrians now." Referring to the chart below, also provided

by Barry Bannister, we see the effects of 35 years of ultra-expansionary

monetary policies:

-

-

-

-

- Chart: Courtesy Barry Bannister

-

- Congressman Paul makes two points in his commentary.

One, each financial crisis over the past 35 years has not been actually

been solved in a final, sustainable manner; rather, they have been papered

over which have created the conditions for a bigger crisis that will have

to be dealt with in the future. And, two, the crisis will be magnified

because it is globalized in nature and "Instead of using globalism

in a positive fashion, it's been used to globalize all the mistakes of

the politicians, bureaucrats, and central bankers."

-

- If your eyes are glazing over all of these numbers then

perhaps you might understand a reference to inflation in all of the Austin

Powers movies. In the movies, the characters of Austin Powers and

Dr. Evil, both played by Michael Myers, travel back and forth between the

late 1960s and the late 1990s. In the first movie, not understanding the

power of inflation, Dr. Evil, still caught in the 1990s, demands a ransom

for threat of destroying the world in the amount of $100 billion for a

world in the 1960s. The 1960s world leaders explain to him that $100 billion

is more than all of the money in the world. Today, $100 billion would barely

qualify as a bailout or stimulus package.

-

- Now the lesson here is that the unthinkable has occurred.

We have expanded the money supply (and commensurate debt) more than 1000-fold

in less than 40 years, yet no one really thinks that we have expanded economic

growth and real wealth to anything near that level.

-

- Rather, the excess money has resulted in a series of

rotating inflationary bubbles. Bubbles in commodities, consumer prices,

and wages are seen as bad, while inflation in stock and real estate assets

are seen as good. But both are symptomatic of an unsustainable system doomed

to failure, as Congressman Paul explains:

-

- Ironically, in the past 35 years, we have benefitted

from this very flawed system. Because the world accepted dollars as if

they were gold, we only had to counterfeit more dollars, spend them overseas...and

enjoy our unearned prosperity. Those who took our dollars and gave us goods

and services were only two anxious to loan those dollars back to us. This

allowed us to export our inflation and delay the consequences we are now

starting to see. But it was never destined to last, and we now have to

pay the piper....Printing dollars over long periods of time may not immediately

push prices up -- yet in time it always does. Now we're seeing catch-up

for past inflating of the money supply. As bad as it is today with $4 a

gallon gasoline, this is just the beginning.

-

- The days of highly-leveraged, borrowed investment speculation

(especially if you want to short a government-protected asset) and"

living la vita leveraged" for consumers are over. The credit contraction

and deleveraging process is going to at the very least serve as a torturous

economic headwind as the effects of 35 years of irresponsible financial

behavior are unwound.

-

- While Treasury Secretary Paulson and most in Congress

are desperately looking to employ measures that prevent a systemic collapse

of world financial markets, such tools will only serve to feed the beast

and make the day of reckoning that much more devastating. Another development

which distinguishes this crisis from others in years past is the lack of

support shown by some free marketer Congressional leaders. I side with

them and believe that we should be trying to starve the beast. This is

going to get a lot worse. Kill this beast now. In the film The Sixth

Day, clones are created to bring people back to life so they never die,

but each time they come back with a congenital mutation that causes the

contraction of each successive life span before cloning is required again.

Toward the end of the movie the wife of the character played by Robert

Duvall begs to be left to rest and not be reincarnated as a clone of herself.

Likewise, some of these financial monstrosities should just be left to

die.

-

- Last week, Richard Fisher, head of the Dallas Federal

Reserve Bank, "speaking solely in [his] own capacity," alerts

us that "the unfunded liabilities from Medicare and Social Security...comes

to $99.2 trillion over the infinite horizon. " Fisher goes on to warn:

-

- This comes to $1.3 million per family of four - over

25 times the average household's income....No combination of tax hikes

and spending cuts, though, will change the total borne by current and future

generations....We know from centuries of evidence in countless economies,

from ancient Rome to today's Zimbabwe, that running the printing press

to pay off today's bills leads to much worse problems later on. The inflation

that results from the flood of money into the economy turns out to be far

worse than the fiscal pain those countries hoped to avoid.

-

- Congressman Paul is a Republican and Richard Fisher was

appointed by a Democrat. But both appear to be drinking from the same Texas

tap water, however regarding the nefarious and inevitable effects of money

printing and inflation. Maybe one day they will be able to bottle it up

and persuade others to drink it. It appears that Fisher could be auditioning

to team up with former Comptroller, David Walker, another "economic

Paul Revere", to serve on Pete Peterson's team in an effort to save

the Republic from economic disaster before it is too late.

-

- A couple of weeks ago, William Poole, formerly of the

St. Louis Fed warned that Fannie and Freddie were insolvent. These aren't

the warnings of bombastic flamethrowers. These are former respected and

responsible government officials who courageously dare to speak the truth!

-

- So things are bad, but how bad? Nouriel Roubini, Chairman

of RGE Monitor and Professor of Economics at the NYU Stern School of Business,

is now being recognized by the financial media for having correctly predicted

many of the afflictions which currently ails our economy. He believes that:

-

- This is not just a subprime mortgage crisis; this is

the crisis of an entire subprime financial system: losses are spreading

from subprime to near prime and prime mortgages; to commercial real estate;

to unsecured consumer credit (credit cards, student loans, auto loans);

to leveraged loans that financed reckless debt-laden LBOs; to muni bonds

that will go bust as hundred of municipalities will go bust; to industrial

and commercial loans; to corporate bonds whose default rate will jump from

close to 0% to over 10%; to CDSs where $62 trillion of nominal protection

sits on top an outstanding stock of only $6 trillion of bonds and where

counterparty risk - and the collapse of many counterparties - will lead

to a systemic collapse of this market.

-

- This will be the most severe U.S. recession in decades

with the U.S. consumer being on the ropes and faltering big time as soon

as the temporary effect of the tax rebates will fade out by mid-summer

(July). This U.S. consumer is shopped out, saving less, debt burdened and

being hammered by falling home prices, falling equity prices, falling jobs

and incomes, rising inflation and rising oil and energy prices. This will

be a long, ugly and nasty U-shaped recession lasting 12 to 18 months, not

the mild 6 month V-shaped recession that the delusional consensus expects.

-

- While I agree with the devastating effects due to the

harmful complex inter-linkages in the world financial markets and the negative

feedback loops between the financial world and the real economy that Roubini

cites above, I believe that the our fate will be much worse than Roubini's

12-18 months U-shaped recession, a prediction that already exceeds the

most bearish forecast among the mainstream economists. As a Keynesian,

Roubini believes that a deteriorating economy will lead to a large decrease

in aggregate demand, resulting in much lower energy and other commodity

prices. Keynesians do not place much weight in monetary supply concerns

in their analysis. As an Austrian, I believe that much more commodity inflation

has been baked into the cake, and rising commodity prices are more likely

to have an effect on the length and intensity of the recession than the

recession is likely to have an impact on commodity prices, at least initially.

Furthermore, Keynesians believe that aggressive fiscal stimulus packages

can be implemented in order to prevent any recession. And there's the rub.

-

- While I expect the Keynesians to win out and for us to

receive the biggest fiscal expansion of government, coupled with continued

loose monetary policy, in the history of the world in order to limit the

fallout of the economic collapse Roubini outlines above, I expect it to

blow the budget through the roof to crash the dollar. There will be no

starving of any beasts. There will only be the creation of bigger wealth-sucking

leviathan bureaucracies. Other governments will reject our paper, painful

as it might be for them initially, and the US dollar will lose its status

as the world's reserve currency. Yields on US treasuries will soar. Other

governments are inflating their currencies as well, so gold be the only

real winner in this race to the bottom for fiat money.

-

- Sadly, we will reject willfully accepting the consequences

as paying the piper today in return for a road that will lead us down the

path of unrecoverable ruin that will permanently harm our place in the

world. The time to heed the warnings of Ron Paul is growing short:

-

- I have for the past 35 years, expressed my grave concern

for the future of America. The course we have taken over the past century

has threatened our liberties, security, and prosperity. In spite of these

long held concerns, I have days - growing more frequent all the time -

when I'm convinced that time is now upon that some Big Events are about

to occur. These fast approaching events will not go unnoticed. They will

affect all of us. They will not be limited to just some areas of our country.

The world economy and political system will share in the chaos about to

be unleashed.

-

- In order to position yourself for such an investment

environment I refer you to my commentary

- http://www.greenfaucet.com/the-market/coal-and-gold-are-your-two-best-bets

-

- http://www.greenfaucet.com

|