Smoking gun oil and gas map? You decide:

Hello, Jeff - Note the date of this article, January 2014. Just

about the time that Guinea had Ebola cases spreading but not identified.

Could oil = Ebola? The people in W Africa are certain that the W

African strain that appears to have started in early December, or even

sooner, they care convinced that Ebola was being spread on purpose.

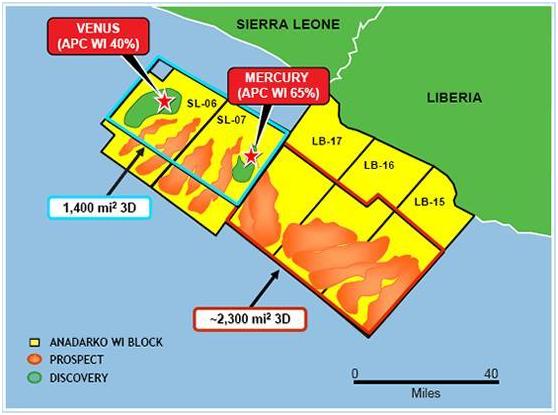

There sometimes is some basis for rumor.. I have found a map of

oil wells, areas of oil exploration as well as off shore proposed and

operating oil, gas maps. It is a mighty big coincidence that these

maps if overlaid a map of Ebola infection match.

This strain is different and I believe it is airborne, maybe not in the

sense of Influenza but in the sense of TB. TB is spread within the

droplets that contain the bacteria. A person sneezes or coughs and

the droplets that get released into the air are infectious and thus the

bacterial disease spreads. I believe that this Ebola strain is spreading

in the manner of TB.

Check out the map and YOU decide. i have also posted a January 2014

analysis of some of the oil and gas industry proposed and working sites.

My guess is the oil industry may possibly have other ideas for Dolotown

and West Point townships in Liberia and that does not include housing

poor people...

You decide.

Patty

http://www.platts.com/news-feature/2014/oil/africa-oil-gas-energy-outlook/west-africa-oil-gas

West Africa Starts Opening Up More Deepwater Oil, Gas Plays

By Jacinta Moran in Cape Town

January 02, 2014

CAPE TOWN -- West Africa's upstream future looks better now than

ever before as the build-up of international oil company interests proceeded

rapidly through 2013 and countries look to open up their deepwater offshore.

Unrivaled opportunities in the form of mergers, bid rounds, farm-ins/outs

and deal making coupled with rising proven oil and gas reserves have made

it one of the principal target destinations for global oil companies.

The fly in the ointment, though, is the apparent increasing propensity

of some governments to alter the fiscal terms after the event, which can

act as deterrent to investment.

Prospects and potential for further oil and gas finds remain exceedingly

positive in West Africa, though, while the region's "presalt," or subsalt,

is also generating considerable interest with 2014 shaping up to be an

active year for seismic and exploratory drilling.

Analysis continues below...

Angola will auction 10 blocks in the onshore Lower Congo and onshore Kwanza

basin in 2014. They are known to have presalt prospects that are said

to be similar to the subsalt layer offshore Brazil where large discoveries

have already been made.

If prospects are as favorable as projected, and new deepwater fields such

as Total's CLOV project come on stream as scheduled, Angola should be

able to increase its oil output to eclipse that of Nigeria.

Angola also has the second largest proven natural gas reserves in sub-Saharan

Africa after Nigeria, with 11 Tcf. In a milestone development and after

many delays, Angola's first LNG venture came on stream in June 2013.

At a cost of $10 billion, Angola LNG is one of the largest single investments

in the country's hydrocarbons sector.

But while the Chevron-led project offers a solution to minimize flaring

by gathering associated gas from offshore oil fields, concerns remain

over the potential weakening of LNG prices in the coming years, and higher

liquefaction costs.

Gabon exploration

Several companies have set their sights on subsalt plays in Gabon, which

sits on the west coast of central Africa, and where Total in October reported

gas and condensate finds on the Diaba block.

Gabon's ministry of energy in October awarded 13 blocks to 11 companies

as part of a long-delayed licensing round, which the former OPEC member

country hopes will reverse a decline in output from a peak of 370,000

b/d in the 1990s.

Marathon, Cobalt, Petronas, Perenco, Noble, ExxonMobil, Eni and Ophir

were among the winners.

But the government's recent decision to delay publishing its proposed

new petroleum law from 2014 to 2015 raises the risks of regulatory uncertainty

for investors.

Industry sources say foreign oil companies are likely to face tougher

terms such as including equity stakes for the state oil company in new

production sharing contracts.

The state-owned Gabon Oil Company is expected to take a 15% equity stake

in all new projects while the law is also expected to propose that at

least 90% of all jobs in the energy sector should be held by locals including

all executive positions.

The energy sector remains crucially important to Gabon's economy-- hydrocarbons

account for between 80% and 90% of it total export earnings.

Equatorial Guinea, meanwhile, is also looking to stretch its oil sector.

The ministry of mines and energy will invite companies to bid on available

blocks in 2014 as it steps up an aggressive exploration program with four

blocks to be offered.

The tiny former Spanish colony started pumping oil in the mid-1990s, with

oil peaking at around 360,000 b/d in 2008, before dipping to 285,000 b/d

in 2013 as some fields started maturing.

Combined with gas, the country's output is around 320,000 b/d of oil equivalent.

Liberia, Ghana, Cote D'Ivoire, Benin

Liberia, still recovering from a civil war, is planning to offer 11 offshore

exploration blocks in a new licensing round planned for launch from mid-2014,

which will include two ultra-deep concessions for the first time.

The focus of the next round will be on the offshore Harper Basin, which

borders the West African country's eastern maritime boundary with Cote

d'Ivoire. State-owned NOCAL is still working on a draft new oil and as

policy.

Interest has also been piqued in offshore Cote d'Ivoire following discoveries

by Total and Tullow Oil. The West African nation is now opening up new

exploration acreage in the country's ultra deepwater as it hopes to hit

an ambitious 200,000 b/d by 2016 from current levels of 30,000 b/d.

Ghana, though still considered a minnow, expects oil production to more

than double to 200,000 b/d by 2020 as output increases from the Jubilee

field and other projects come on stream.

Apart from Tullow's main producing asset, the Jubilee field, the company

is working on a number of other prospects in Ghana, such as the Tweneboa,

Enyenra and Ntomme (TEN) field, all of which could underpin Ghana's oil

production levels over the medium term.

A national oil policy has been approved by cabinet and around $20 billion

is expected to be invested in the upstream over the next five years.

Benin, a tiny neighbor to the east of oil giant Nigeria, has long been

considered a small company play but that may be about to change.

Shell has started drilling block 4, in what it described as a new and

untested area in the country.

Lagos-based South Atlantic Petroleum (SAPETRO), is exploring the Seme

field in block 1 where it is targeting first oil in 2014.

Seme went on stream in 1992 but it was abandoned in 1998 by a succession

of companies including Pan Ocean and Ashland. A significant oil discovery

would help solve Benin's energy woes-- the country is largely dependent

on imported electricity, mostly from Nigeria, Cote d'Ivoire and Ghana.

|

![]()