- As the saying goes : "In a ham and eggs breakfast,

the hen is involved, but the pig is committed".

-

- By my reckoning, Paulson and Central Banks are the chicken

and the world's (stupid) taxpayers are the pig. We have no choice in

the matter, and by the way, to get ham, the pigs are always slaughtered.

-

- My current fear is that we may be in near term for continued

financial meltdown - something is definitely in the works in Washington

D.C. ...

-

- All hell is breaking loose - the DOW closed down 670

points last evening and today asian markets have been battered down again

with the NIKKEI losing 10%, most other asian markets are down 7 - 9 %.

- Oil has corrected down again this week so far as the

outlook for world-wide recession is growing while gold and silver are

now moving higher. Overnight figures are :

-

- Oil

-

-

- $82.63 -3.96 -4.57%

-

- Gold

-

-

- $929.50 +43.00 +4.85%

-

- Gas

-

-

- $6.67 -0.16 -2.27%

-

- I expect another "Sunday announcement" from

officials - the G8 Finance Ministers are meeting today in Washington D.C.

and the IMF are deliberating. Likewise, Pres. W. Bush is to give ANOTHER

announcement today at 16:25 EST. What will this be about ? There could

be a bank moratorium in the pipeline. Or more drastic measures...

-

-

-

-

- The chart above (courtesy of D. Norcini | Tech Lines:

R. Buss) shows that in Euro terms, gold is breaking out and making new

highs - very interesting indeed. As well, in other currencies, Gold is

rocketing to new highs - this is the true currency of last resort as other

currencies devalue in purchasing power - this will become more apparent

as higher inflation in the pipeline comes...

-

- The prospect of hyperinflation is now becoming a REAL

possibility - trillions of dollars are being pumped and nothing is happening

in the credit markets - FEAR is enveloping world markets. We now think

there may be another concerted effort to engage in socialist methods

of the State buying up everything, guaranteeing loans, etc. as in Iceland,

UK, etc. Welcome to October 2008. We would not be surprised to see more

civil unrest as people realize they have been cheated out of their lifetime

savings and pensions.

-

- If you ever thought to be invested in gold and silver

and hard assets - NOW is the time. A storm is brewing over the world

economy and PAPER MONEY is not helping anything it seems. Caveat : we

are also sure that "gold enemies", i.e. Central Banks and their

banks, will try to keep the price on gold below $1000 - there is a fight

coming - Gold .vs. Paper - do not underestimate this fight - it will be

very dirty and it is your government fighting against you and your wealth.

-

- ------------------------------------------------

-

- Here are few recent remarks from elected officials in

the US government:

-

- US House of Rep. Speaker Nancy Pelosi : "It's not

a bailout, it's a buy-in"

- W. Bush : "We have a sound economy"

- Hank Paulson : "Our underlying financial system

is solid"

- Hank Paulson : "The US Dollar is strong"

- As an ambitious student of history in all its twisted

and convoluted probity, or lack thereof, a thought from my Berlin (a rather

appropriate location) office below. The point being, the SPIN is no

longer working - the Emperor, or better said, the Empire, has no clothes.

He is now laid bare for all to see - now the financial spin doctors are

about to foist even more upon us - just wait.

-

- The Big Lie is a propaganda technique. It was defined

by Adolf Hitler in his 1925 autobiography Mein Kampf (My Struggle) as

a lie so "colossal" that no one would believe that someone "could

have the impudence to distort the truth so infamously".

-

- "If you tell a lie big enough and keep repeating

it, people will eventually come to believe it. The lie can be maintained

only for such time as the State can shield the people from the political,

economic and/or military consequences of the lie. It thus becomes vitally

important for the State to use all of its powers to repress dissent, for

the truth is the mortal enemy of the lie, and thus by extension, the truth

is the greatest enemy of the State."

-

- And here was a response from Joseph Goebbels to Churchill

and Co. -

- also very interesting.

-

- "One should not, as a rule, reveal one's secrets,

since one does not know if and when one may need them again. The essential

English leadership secret does not depend on particular intelligence.

Rather, it depends on a remarkably stupid thick-headedness. The English

follow the principle that when one lies, one should lie big, and stick

to it. They keep up their lies, even at the risk of looking ridiculous."

-

- Like I have said in the past : Repeat the government's

mantra over and over again until you believe it : Strong Dollar, Sound

Economy, All is Well, Jobs will not be Lost, Economic Fundamentals are

Good.

-

- By the way, Gordon Brown, UK Prime Minister, is now seemingly

intent upon using Anti-Terror Laws against Iceland for sandbagging UK

citizens accounts in icelandic banks which have been nationalized- no

payouts at the moment, if ever. Gordo, why dont you just bomb them ?

God knows, there can be a case made for the outcast Icelandic Taliban

in Iceland's extensive cave systems... briefcases full of Kronor, Russian

Rubles** and even a few of the Queen's pounds - this is absolutely hilarious

if it were not totally true.

-

- (** note: Iceland was turned down by the US, UK and Euroland

when submitting for help on a loan bailout for its banks. In the end,

it turned to Russia to secure an $8 billion loan so much for so-

called "friends and allies". I suppose Russia will now have

secured submarine bases in the North Atlantic)

-

- As I stated above - the "Financial Powers that Be"

-

- have been meeting and are in close consultation,

- are meeting today in Washington D.C.,(IMF and World Bank)

- will continue to meet on the weekend in Washington D.C.

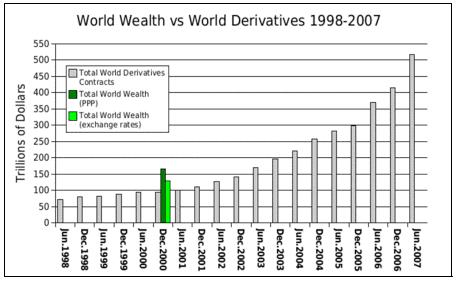

- A final chart : in the last months, hundreds of billions

have been literally created and thrown into the financial arena to try

and "calm the markets". We should realize that the total amount

of OTC derivatives are on magnitude of 16x the world's entire GDP, or,

approximately 650 trillion dollars in June 2008.

-

-

-

-

-

-

- If this is the amount of "bad debt" on the

books, and which must be cleansed, then I submit we shall soon see complete

meltdown of the financial system and of general solid businesses with

no access to credit to finance things like payroll, inventory or investment

plans - they will collapse.

-

- It is pure folly to hear politicians and news stories

of "Are we in a recession?". My answer is beginning to turn

- I now say we are entering a Depression - as I have often surmised in

my GMR Newsletter. And if things continue on this route, we shall be

entering a hyperinflationary depression. Why? Because now the Central

Banks are likely to embark upon one of the greatest reflation programs

ever witnessed in the modern world.

-

- Hyperinflationary because the world is facing a deflationary

menace - that of too many goods in an environment of fear, panic and need

to save. Thus those goods will linger and stagnate. No new widgets or

gadgets need to be built. The bad debt is coming home to you - now.

-

- It was interesting to read a few reader comments sent

to me, which said "Thank God I did not invest in gold" - it

has dropped so much" . My current thoughts are : those readers shall

likely eat their words if things get wholly out of control. In any case,

the amount of reflation necessary will be horrendous. Funny, but looking

at the gold charts, I see gold in most major currencies has zoomed up

(NOT down) - hard to understand those readers. The major stock indices

are getting hammered down 30, 40 or even 50 percent while gold has maintained

a steady uptrend. That is why gold is STILL in a stealth up move - when

and/or if "joe public" realize this, there will be a jump.

I expect at that point, gold controls to be enacted. How and When and

What I don't know. It all hinges on this ONGOING bailout and how the

markets respond - it's no longer the "financial engineers" in

control, it's the politicians, the bureaucrats and the state-sponsored

hoodlums. I leave the rest to your imagination. And if you're wondering,

yes, I am considerably perturbed at these bumbling idiots...

-

- Just to note, as I had predicted, we see Central Banks

and their recent press statements:

-

- inflation is coming down ; it is no longer a major threat

- the economy is weakening - we have room to cut rates

- Are we headed to a full-blown Kondratieff Winter? ...

certainly it looks so. Finally, I want to throw in an interesting astrological

tidbit - I read and study alot of this but keep it mostly to myself.

- We have entered a Pluto-Capricorn cycle having just passed

out of the Sagittarius. Capricorn house is for the next 16 years and

is indicative of deflation, fear, panic, less freedoms, low returns.

- Both Kondratieff and Pluto in Capricorn point to investment

in commodities, food, agriculture.

-

- Randolph Buss

- diiportal@dinl.net

-

-

- Randolph Buss | DINL

- located in Berlin, Germany | Zürich, Switzerland

- please contact me for a non-binding consultation

-

- _______________________________________________

-

- Personal appointments in Berlin, Hamburg, Munich, Frankfurt,

Zurich

- or by arrangement at mutual location

-

- _______________________________________________

-

- The Markets · Macro Economic Outlook ·

Technical Analysis & Charts

- Fundamental Research · Independent Asset Management

- Portfolio Advisory

-

-

- tel: +49 30 850 73371

- skype: dinl.net

- http://www.dinl.net

- Berlin, Germany

- © copyright 2004-2008

|