- The price of crude oil today is not made according to

any traditional relation of supply to demand. It's controlled by an elaborate

financial market system as well as by the four major Anglo-American oil

companies. As much as 60% of today's crude oil price is pure speculation

driven by large trader banks and hedge funds. It has nothing to do with

the convenient myths of Peak Oil. It has to do with control of oil and

its price. How?

-

- First, the crucial role of the international oil exchanges

in London and New York is crucial to the game. Nymex in New York and the

ICE Futures in London today control global benchmark oil prices which in

turn set most of the freely traded oil cargo. They do so via oil futures

contracts on two grades of crude oil-West Texas Intermediate and North

Sea Brent.

-

- A third rather new oil exchange, the Dubai Mercantile

Exchange (DME), trading Dubai crude, is more or less a daughter of Nymex,

with Nymex President, James Newsome, sitting on the board of DME and most

key personnel British or American citizens.

-

- Brent is used in spot and long-term contracts to value

as much of crude oil produced in global oil markets each day. The Brent

price is published by a private oil industry publication, Platt's. Major

oil producers including Russia and Nigeria use Brent as a benchmark for

pricing the crude they produce. Brent is a key crude blend for the European

market and, to some extent, for Asia.

-

- WTI has historically been more of a US crude oil basket.

Not only is it used as the basis for US-traded oil futures, but it's also

a key benchmark for US production.

-

-

-

-

- 'The tail that wags the dog'

-

- All this is well and official. But how today's oil prices

are really determined is done by a process so opaque only a handful of

major oil trading banks such as Goldman Sachs or Morgan Stanley have any

idea who is buying and who selling oil futures or derivative contracts

that set physical oil prices in this strange new world of "paper oil."

-

- With the development of unregulated international derivatives

trading in oil futures over the past decade or more, the way has opened

for the present speculative bubble in oil prices.

-

- Since the advent of oil futures trading and the two major

London and New York oil futures contracts, control of oil prices has left

OPEC and gone to Wall Street. It is a classic case of the "tail that

wags the dog."

-

- A June 2006 US Senate Permanent Subcommittee on Investigations

report on "The Role of Market Speculation in rising oil and gas prices,"

noted, "there is substantial evidence supporting the conclusion that

the large amount of speculation in the current market has significantly

increased prices."

-

-

- What the Senate committee staff documented in the report

was a gaping loophole in US Government regulation of oil derivatives trading

so huge a herd of elephants could walk through it. That seems precisely

what they have been doing in ramping oil prices through the roof in recent

months.

-

- The Senate report was ignored in the media and in the

Congress.

-

- The report pointed out that the Commodity Futures Trading

Trading Commission, a financial futures regulator, had been mandated by

Congress to ensure that prices on the futures market reflect the laws of

supply and demand rather than manipulative practices or excessive speculation.

The US Commodity Exchange Act (CEA) states, "Excessive speculation

in any commodity under contracts of sale of such commodity for future delivery

. . . causing sudden or unreasonable fluctuations or unwarranted changes

in the price of such commodity, is an undue and unnecessary burden on interstate

commerce in such commodity."

-

- Further, the CEA directs the CFTC to establish such trading

limits "as the Commission finds are necessary to diminish, eliminate,

or prevent such burden." Where is the CFTC now that we need such limits?

-

- They seem to have deliberately walked away from their

mandated oversight responsibilities in the world's most important traded

commodity, oil.

-

- Enron has the last laugh

-

- As that US Senate report noted:

-

- "Until recently, US energy futures were traded exclusively

on regulated exchanges within the United States, like the NYMEX, which

are subject to extensive oversight by the CFTC, including ongoing

monitoring to detect and prevent price manipulation or fraud. In recent

years, however, there has been a tremendous growth in the trading of contracts

that look and are structured just like futures contracts, but which are

traded on unregulated OTC electronic markets. Because of their similarity

to futures contracts they are often called "futures look-alikes."

-

- The only practical difference between futures look-alike

contracts and futures contracts is that the look-alikes are traded

in unregulated markets whereas futures are traded on regulated exchanges.

The trading of energy commodities by large firms on OTC electronic exchanges

was exempted from CFTC oversight by a provision inserted at the behest

of Enron and other large energy traders into the Commodity Futures Modernization

Act of 2000 in the waning hours of the 106th Congress.

-

- The impact on market oversight has been substantial.

NYMEX traders, for example, are required to keep records of all trades

and report large trades to the CFTC. These Large Trader Reports, together

with daily trading data providing price and volume information, are the

CFTC's primary tools to gauge the extent of speculation in the markets

and to detect, prevent, and prosecute price manipulation. CFTC Chairman

Reuben Jeffrey recently stated: "The Commission's Large Trader information

system is one of the cornerstones of our surveillance program and enables

detection of concentrated and coordinated positions that might be used

by one or more traders to attempt manipulation."

-

- In contrast to trades conducted on the NYMEX, traders

on unregulated OTC electronic exchanges are not required to keep records

or file Large Trader Reports with the CFTC, and these trades are exempt

from routine CFTC oversight. In contrast to trades conducted on regulated

futures exchanges, there is no limit on the number of contracts a speculator

may hold on an unregulated OTC electronic exchange, no monitoring of trading

by the exchange itself, and no reporting of the amount of outstanding contracts

("open interest") at the end of each day."

- http://us.f537.mail.yahoo.com/ym/ShowLetter?box=Inbox&MsgId=9644_1

- 50045629_21436062_2104_73204_0_654756_147099_4029258801&body

- Part=2&tnef=&YY=28641&y5beta=yes&y5beta=yes&order=down&sort=date

- &pos=0&view=a&head=b&ViewAttach=1&Idx=26#04000001

- 1

-

- Then, apparently to make sure the way was opened really

wide to potential market oil price manipulation, in January 2006, the Bush

Administration's CFTC permitted the Intercontinental Exchange (ICE), the

leading operator of electronic energy exchanges, to use its trading terminals

in the United States for the trading of US crude oil futures on the ICE

futures exchange in London called "ICE Futures."

-

- Previously, the ICE Futures exchange in London had traded

only in European energy commodities Brent crude oil and United Kingdom

natural gas. As a United Kingdom futures market, the ICE Futures exchange

is regulated solely by the UK Financial Services Authority. In 1999, the

London exchange obtained the CFTC's permission to install computer terminals

in the United States to permit traders in New York and other US cities

to trade European energy commodities through the ICE exchange.

-

- The CFTC opens the door

-

- Then, in January 2006, ICE Futures in London began trading

a futures contract for

-

- West Texas Intermediate (WTI) crude oil, a type of crude

oil that is produced and delivered in the United States. ICE Futures also

notified the CFTC that it would be permitting traders in the United States

to use ICE terminals in the United States to trade its new WTI contract

on the ICE Futures London exchange. ICE Futures as well allowed traders

in the United States to trade US gasoline and heating oil futures on the

ICE Futures exchange in London.

-

- Despite the use by US traders of trading terminals within

the United States to trade US oil, gasoline, and heating oil futures contracts,

the CFTC has until today refused to assert any jurisdiction over the trading

of these contracts.

-

-

-

-

-

- Persons within the United States seeking to trade key

US energy commodities US crude oil, gasoline, and heating oil futures

are able to avoid all US market oversight or reporting requirements

by routing their trades through the ICE Futures exchange in London instead

of the NYMEX in New York.

-

- Is that not elegant? The US Government energy futures

regulator, CFTC opened the way to the present unregulated and highly opaque

oil futures speculation. It may just be coincidence that the present CEO

of NYMEX, James Newsome, who also sits on the Dubai Exchange, is a former

chairman of the US CFTC. In Washington doors revolve quite smoothly between

private and public posts.

-

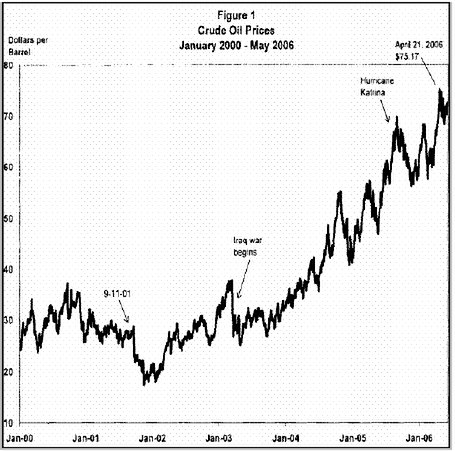

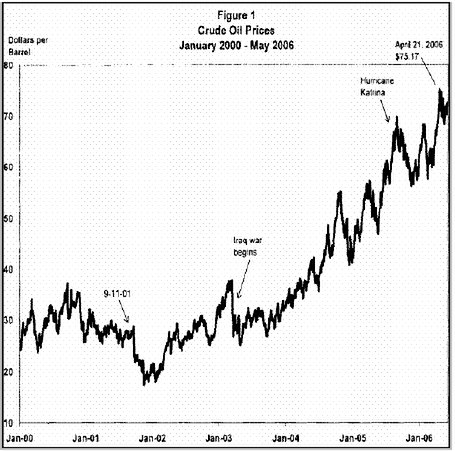

- A glance at the price for Brent and WTI futures prices

since January 2006 indicates the remarkable correlation between skyrocketing

oil prices and the unregulated trade in ICE oil futures in US markets.

Keep in mind that ICE Futures in London is owned and controlled by a USA

company based in Atlanta Georgia.

-

- In January 2006 when the CFTC allowed the ICE Futures

the gaping exception, oil prices were trading in the range of $59-60 a

barrel. Today some two years later we see prices tapping $120 and trend

upwards. This is not an OPEC problem, it is a US Government regulatory

problem of malign neglect.

-

- By not requiring the ICE to file daily reports of large

trades of energy commodities, it is not able to detect and deter price

manipulation. As the Senate report noted, "The CFTC's ability to detect

and deter energy price manipulation is suffering from critical information

gaps, because traders on OTC electronic exchanges and the London ICE Futures

are currently exempt from CFTC reporting requirements. Large trader reporting

is also essential to analyze the effect of speculation on energy prices."

-

- The report added, "ICE's filings with the Securities

and Exchange Commission and other evidence indicate that its over-the-counter

electronic exchange performs a price discovery function -- and thereby

affects US energy prices -- in the cash market for the energy commodities

traded on that exchange."

-

-

- Hedge Funds and Banks driving oil prices

-

- In the most recent sustained run-up in energy prices,

large financial institutions, hedge funds, pension funds, and other investors

have been pouring billions of dollars into the energy commodities markets

to try to take advantage of price changes or hedge against them. Most of

this additional investment has not come from producers or consumers of

these commodities, but from speculators seeking to take advantage of these

price changes. The CFTC defines a speculator as a person who "does

not produce or use the commodity, but risks his or her own capital trading

futures in that commodity in hopes of making a profit on price changes."

-

- The large purchases of crude oil futures contracts by

speculators have, in effect, created an

-

- additional demand for oil, driving up the price of oil

for future delivery in the same manner that additional demand for contracts

for the delivery of a physical barrel today drives up the price for oil

on the spot market. As far as the market is concerned, the demand for a

barrel of oil that results from the purchase of a futures contract by a

speculator is just as real as the demand for a barrel that results from

the purchase of a futures contract by a refiner or other user of petroleum.

-

- Perhaps 60% of oil prices today pure speculation

-

- Goldman Sachs and Morgan Stanley today are the two leading

energy trading firms in the United States. Citigroup and JP Morgan Chase

are major players and fund numerous hedge funds as well who speculate.

-

- In June 2006, oil traded in futures markets at some $60

a barrel and the Senate investigation estimated that some $25 of that was

due to pure financial speculation. One analyst estimated in August 2005

that US oil inventory levels suggested WTI crude prices should be around

$25 a barrel, and not $60.

-

- That would mean today that at least $50 to $60 or more

of today's $115 a barrel price is due to pure hedge fund and financial

institution speculation. However, given the unchanged equilibrium in global

oil supply and demand over recent months amid the explosive rise in oil

futures prices traded on Nymex and ICE exchanges in New York and London

it is more likely that as much as 60% of the today oil price is pure speculation.

No one knows officially except the tiny handful of energy trading banks

in New York and London and they certainly aren't talking.

-

- By purchasing large numbers of futures contracts, and

thereby pushing up futures

-

- prices to even higher levels than current prices, speculators

have provided a financial incentive for oil companies to buy even more

oil and place it in storage. A refiner will purchase extra oil today, even

if it costs $115 per barrel, if the futures price is even higher.

-

- As a result, over the past two years crude oil inventories

have been steadily growing, resulting in US crude oil inventories that

are now higher than at any time in the previous eight years. The large

influx of speculative investment into oil futures has led to a situation

where we have both high supplies of crude oil and high crude oil prices.

-

- Compelling evidence also suggests that the oft-cited

geopolitical, economic, and natural factors do not explain the recent rise

in energy prices can be seen in the actual data on crude oil supply and

demand. Although demand has significantly increased over the past few years,

so have supplies.

-

- Over the past couple of years global crude oil production

has increased along with the increases in demand; in fact, during this

period global supplies have exceeded demand, according to the US Department

of Energy. The US Department of Energy's Energy Information Administration

(EIA) recently forecast that in the next few years global surplus production

capacity will continue to grow to between 3 and 5 million barrels per day

by 2010, thereby "substantially thickening the surplus capacity cushion."

-

- Dollar and oil link

-

- A common speculation strategy amid a declining USA economy

and a falling US dollar is for speculators and ordinary investment funds

desperate for more profitable investments amid the US securitization disaster,

to take futures positions selling the dollar "short" and oil

"long."

-

- For huge US or EU pension funds or banks desperate to

get profits following the collapse in earnings since August 2007 and the

US real estate crisis, oil is one of the best ways to get huge speculative

gains. The backdrop that supports the current oil price bubble is continued

unrest in the Middle East, in Sudan, in Venezuela and Pakistan and firm

oil demand in China and most of the world outside the US. Speculators trade

on rumor, not fact.

-

- In turn, once major oil companies and refiners in North

America and EU countries begin to hoard oil, supplies appear even tighter

lending background support to present prices.

-

- Because the over-the-counter (OTC) and London ICE Futures

energy markets are unregulated, there are no precise or reliable figures

as to the total dollar value of recent spending on investments in energy

commodities, but the estimates are consistently in the range of tens of

billions of dollars.

-

- The increased speculative interest in commodities is

also seen in the increasing popularity of commodity index funds, which

are funds whose price is tied to the price of a basket of various commodity

futures. Goldman Sachs estimates that pension funds and mutual funds have

invested a total of approximately $85 billion in commodity index funds,

and that investments in its own index, the Goldman Sachs Commodity Index

(GSCI), has tripled over the past few years. Notable is the fact that the

US Treasury Secretary, Henry Paulson, is former Chairman of Goldman Sachs.

-

- F. William Engdahl is an Associate of the Centre for

Research on Globalization (CRG) and author of A Century of War: Anglo-American

Oil Politics and the New World Order. He may be contacted at info@engdahl.oilgeopolitics.net

-

-

- 1 United States Senate Premanent Subcommittee on

Investigations, 109th Congress 2nd Session, The Role of Market speculation

in Rising Oil and Gas Prices: A Need to Put the Cop Back on the Beat; Staff

Report, prepared by the Permanent Subcommittee on Investigations of the

Committee on Homeland Security and Governmental Affairs, United States

Senate, Washington D.C., June 27, 2006. p. 3.

|